Download TurboTax Business 2018 Tax Software Online For Windows

$119.99 $16.99

Product Summary:

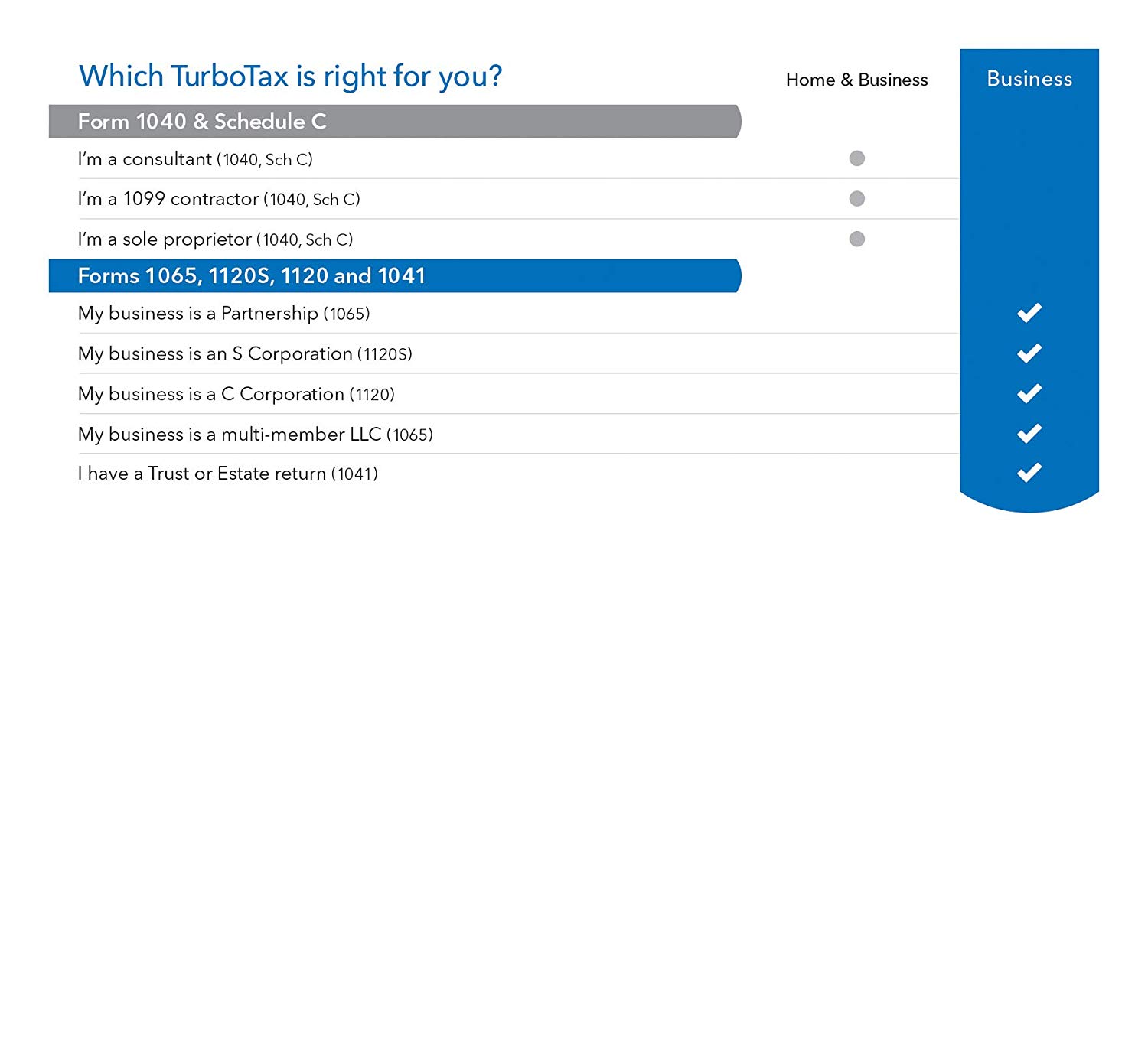

- TurboTax Business works best if your small business is a partnership, S Corp, C Corp, multi-member LLC, or for trusts and estates

- Prepare and file your business or trust taxes with confidence

- Get guidance in reporting income and expenses

- Boost your bottom line with industry-specific tax deductions

- Create W-2 and 1099 tax forms for employees and contractors

- Includes 5 free federal e-files, state preparation additional

- Windows only

Note:We will send the download file via Email after payment successfully.

Get your taxes done right with TurboTax 2018

TurboTax Business works best if your small business:

- Is a Partnership, S Corporation, C Corporation, or multi-member LLC

- Has revenue of less than $250,000

- Has fewer than five employees

TurboTax coaches you every step of the way and double checks your return as you go, so you can be confident your business taxes are done right.

- Customized to your industry, to spot commonly-overlooked deductions and credits

- Up-to-date with the latest tax laws

- No tax knowledge needed – takes your answers to simple questions about your business and fills out all the right forms

- Help along the way—get answers to your product questions, so you won’t get stuck

- Includes audit alerts—flags areas that might trigger an IRS audit

- Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

always love it, I am accounting bookkeeper and tax person. Use it every year.

Thomas J Tuppein –

I am running Win7 Home Premium (64bit)& have used TurboTax Business for the past two years.

I have always been very pleased with the product, though it has its little quirks like any piece of software.

Wallymortar –

I’ve been using TurboTax for my Sub-S corporation tax return for the last 4 years. I find it easy to use and I like the ability to switch from the interview and check the forms as I go. Transferring the data from the previous years return is time saving and helps me not to miss something. I like the fact that I can pay have the return checked by a professional and also buy audit protection in case I make a mistake. My business activity and tax returns for each year are pretty consistent and the question and answer interview alerts you to things you may want to research a little before choosing how to answer the questions.

Filing electronically is easy and If you have to file an extension you can do it through the program and have a record that you filed for it. A few years ago I sent in the extension and when I filed the completed the return the IRS said I hadn’t filed an extension. It would have been much easier to prove if I had filed the extension using TurboTax because they have a record of it.

Victoria –

TurboTax is a reliable, thoroughly modern tool for addressing one of the most vexatious tasks in all of small business…tax preparation. In Interview mode you are introduced in a mostly painless way to the intricacies of the tax code that even professionals don’t always grasp. You can then switch to Forms mode and see on facsimiles of the actual schedules how your answers set up. This modality is not unique to TurboTax, but the TT Business team has commendably sought to continuously refine and streamline the process.

I appreciate the thought and care TT has put into making the Interview questions and help resources relevant and intelligible. Newbies won’t find a genie in a bottle here, but with a little application, nearly everyone can prepare a creditable business return.

Walter Jonas –

This is the second year that I have used Turbo Tax Business to complete my small business taxes. I would not be able to do them without it. I do wish it would have a line for mileage but with that being my major complaint I would have to say that I love it. You must admit that a few hours of a slight headache at the cost of $24.99 is much better than what your accountant would charge. If you know your EIN and State id number and have a profit/loss report from QuickBooks then you are set and can do your own returns with this software.

Danny Ahrens –

Have used TurboTax for years – by far the best tax prep software. People complaining about incorrect forms have to blame the government – Intuit is on it with getting forms out and constantly updating, but they can’t update until the government publishes the forms. Software lets you know when you are ready to file – meaning that all correct forms are in. I file taxes for 9 companies, including LLC’s, S-corps and LLP’s

Geoffrey P Skipton –

TurboTax is a frugal clueless taxpayer’s lifesaver! Paying taxes is hard in more than one way, but TurboTax at least makes you think that it’s sort of easy. It’s not fast if you’re a newbie, but there is a lot of good information to guide you and a forum you can post in if you need to. I use TurboTax for my business and personal taxes and I plan to continue to use it year after year.

Nate Garn –